Legacy Management Consulting is Dead: Why Anti-Consulting Will Win in the Age of AI

In this piece, Thinktiv champions “Anti-Consulting,” a disruptive value creation alternative to the incrementalism and one-size-fits-all market analysis that are the hallmarks of Legacy Management Consulting. In a business environment that is increasingly software-centric, we address the sharp contrasts between the two approaches and the value they each deliver, and illustrate why the rise of increasingly powerful AI technologies will accelerate the shift to new consulting models focused on sustainable revenue growth and competitive advantage.

Introduction

Over the years, Thinktiv clients—from large enterprises to PE/Growth Equity sponsors to emerging growth CEOs — have often told us that our projects didn’t feel like strategy consulting projects they had experienced before. At the conclusion of the engagement, they were feeling energized, aligned with their colleagues and board, and empowered with clarity on a path forward – a testimony to the uniquely actionable, integrated, and impactful value creation strategies we deliver to software-centric businesses.

More recently, one of our clients at a large private equity fund, enjoying a similar experience, told us: “You know what I like about you people and your programs? You’re the Anti-Consultants.” We thought it was an exceptional distillation of our worldview and the value we deliver.

That common perspective from our clients derives from their longstanding experience with the Management Consulting Industrial Complex (the MCIC)—large-scale management consulting firms that are increasingly misaligned with the needs of company leadership and investor portfolio operating teams that pay (a ton) for their work.

The sentiment surfaces after they are able to contrast their legacy consulting experiences with Thinktiv’s approach to integrated value creation, a model that is something fundamentally new and more impactful, that enables immediate forward motion, and that is aligned to the capitalization goals of all shareholders. It’s why we’ve now adopted the Anti-Consultant nickname—and wear the label as a badge of honor.

Recently, as the market has dramatically shifted toward an AI-first mindset, established businesses are realizing that the rise of Generative AI represents both an existential business threat and an engine for new avenues of sustainable growth. As they grapple to find their strategic footing in response, the glaring differences between Anti-Consulting and Legacy Management Consulting become much starker, and the potential consequences of sticking with the status quo become more dire.

Why are we seeing an undeniable uptick in the appetite for a new value creation model? Why is GenAI a potential catalyst for the demise of the MCIC and the rise of Anti-Consulting? Let’s explore the answers.

Legacy Management Consulting no longer meets the value creation needs of software-centric businesses.

There is an enormous gap between the problems that company leaders and PE/Growth Equity operating teams need to solve, and the ability of legacy management consultants to solve them. This is especially true for software-centric businesses, where unique complexity and market velocity mandates timely, highly-integrated, customized, and actionable strategies.

.png?width=2056&height=1400&name=Group%201205%20(1).png)

In these environments, executive management and investor operating teams have similar challenges.

- Accelerating value creation in a software-centric business is very difficult. They must maneuver constantly to make informed decisions and take decisive action in highly complex and volatile competitive environments.

- They are capacity constrained. Any senior executive or portfolio operating lead reading this immediately relates. There is too much to do, and not enough time to do it.

- They are putting out fires vs. aligning on strategies. There is always a new pressing issue that fragments the attention of leadership, leaving discussions of strategy for subsets of the team in fleeting whiteboard sessions, or at best, in brief off-site planning events.

- There is no integrated playbook for aligning action to value creation. Teams often wrap themselves around the axle of tactical plans without considering the bigger goal of maximizing the value of their next capitalization event.

- They typically have specialized, siloed, outdated, or absent expertise. This is particularly pervasive when it comes to modern product management and roadmap strategy. That said, even when the individuals involved are exceptional, they are constrained by all of the above.

In an increasingly dynamic, highly volatile competitive environment that demands informed, decisive action, company management and investor operating teams find out the hard (expensive) way that the usual suspects in the MCIC fall far short in their ability to provide meaningful help. Why?

- Legacy consultants are poorly aligned to drive value creation strategies for software-centric businesses. Historically this just meant the MCIC was poorly aligned only to software companies, but in an era where EVERY company must now be at least in part a software-centric business, that gap is expanding.

- Legacy consultant business models are built on the basis of long-term, deeply entrenched programs, mostly focused on cost takeout and incremental gains. In the middle market. This approach is diametrically opposed to the needs of middle-market, software-centric businesses who almost always have institutional investors on their capital stack. When those firms invest, their capital is intended to maximize the value of that business in advance of the company’s next capital transaction, within a time frame pegged to an expected holding period. In private equity, that window is typically 3-5 years. The MCIC isn’t designed to solve problems quickly, so why spend millions on programs that will only deliver value to future investors?

- Legacy consultants over index on homogenous market views and addressable TAMs, rather than helping individual businesses carve winning value creation strategies. What good is a “market study” to an executive team if no one is helping them figure out how to attack it? We get it. The market is big. These are the players and dynamics. Now how do we win? That part is typically not included in the 300-slide report sitting on the conference room table.

- Legacy consultants charge a metric S%#+ -ton of money for work that often ends up sitting on the shelf. Sure, it’s good work, but most of the time it has delivered no measurable value, particularly when weighed against the size of the tab.

We’ve seen this gap—and dissatisfaction with the status quo—significantly expand during the economic headwinds of the past two years. With it has come an increasing appetite—especially from PE/Growth Equity sponsors focused on software and software-enabled services businesses—for a new model that delivers more measurable business value for the consulting dollars spent. That helps businesses carve superior outcomes within the cycles of capitalization. That aligns company leadership, investor operating teams, and the Board to a unified, actionable strategy for leading and winning a market category. In other words, we see a rapidly accelerating demand for Anti-Consulting.

What is Anti-Consulting?

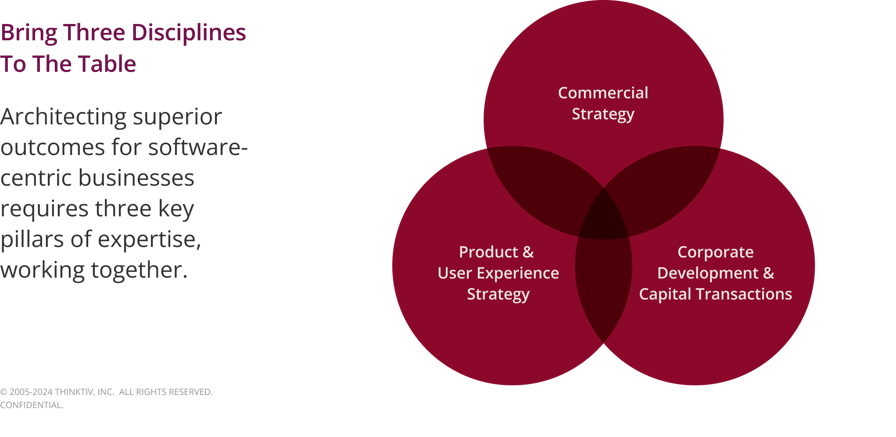

Now, how have we earned the right to claim the title of Anti-Consultant when it comes to value creation? Over 15 years ago, we pioneered a highly differentiated and integrated approach to value creation built on decades of wisdom in building, operating, and exiting software-centric businesses. That model has been delivering outsized outcomes for companies and their investors ever since.

.png?width=2042&height=1438&name=Group%201203%20(1).png)

Without diving too deeply into details of how we do this, let’s focus on the core principles.

Put it this way: How many MCIC consultants do you know who have ever sold software? Delivered a winning software product to market? Overseen a win-win strategic acquisition, buyout, or growth capital transaction?

Take your time. We’ll wait.

THINKTIV'S APPROACH

Problem-solve with those disciplines integrated. Companies make the mistake of tackling holistic, architectural challenges—like value creation—in silos or through fragmented initiatives. The operating teams within Growth and PE firms are almost always structured to deliver help in the same way. Underwhelming growth is not a product problem. Or a messaging problem. Or a sales operations problem. It’s an everything problem—how category leadership, solution differentiation, go-to-market effectiveness, and customer value expansion fit together. If businesses are approaching value creation without looking at the integrated whole, they are guaranteed to miss their opportunity for an optimal outcome.

Diagnose and weigh the constraints. Imagine an architect designing a dream house without understanding the client’s available budget, timeline, or expectations of quality. Or not having command of labor availability, material costs, or permitting processes. The same applies when building value creation plans for these types of businesses. You must assess variables like remaining capital, technical debt, capacity and expertise of the team, customer perspective, and numerous other factors, and weigh the value creation potential of any given strategy against them. This becomes even more critical when the discussion in the boardroom is “if we want to be selling this business in 18 months, how can we maximize the exit value?”

Work backward from the outcome. Companies often struggle to visualize how initiatives can work together to accelerate revenue growth and enhance valuation multiples. This is core to our approach. We often tell clients “let’s think about the ideal Confidential Information Presentation (CIP) you would take to market in a sell-side process 2 years from now, and then work backward from there.” When you can define a company’s ideal narrative out on the horizon, it suddenly becomes easier to break down the problems that must be neutralized, see what matters and what doesn’t, identify the value creation levers that must be pulled, and determine the order in which to pull them.

Align and empower management teams. We place a high priority on ensuring that our clients do not become over-reliant on our presence in the business. We love them, but unlike the MCIC, we don’t want our teams entrenched with them for the long term. We want them aligned on a mission and armed with the tools to deliver on it. Our proprietary strategy frameworks and prioritized value creation plans align and elevate the mindset of client executive teams, enabling them to strategically plan and execute toward great outcomes when we are no longer involved.

Go faster. Especially in middle-market Private Equity, where investments have a fairly uniform expected range of cash-on-cash returns within a constrained period of time, every day counts in terms of IRR. Portfolio companies often waste quarters or years chasing the wrong problems, ignoring what truly differentiates them, building products that aren’t aligned to customer demand, and selling the wrong solutions to the wrong people in a suboptimal business model. The earlier you can achieve alignment on an integrated value creation plan, the more every single day can become a value multiplier on the business. With our clients, we get there in 90 days.

.png?width=2056&height=1400&name=Group%201206%20(1).png)

We’ve just defined the core value creation principles of Anti-Consulting and contrasted them with the increasingly outdated incrementalism and one-size-fits-all market perspectives of Legacy Management Consulting. Let’s now focus on why the rise of Gen AI makes this contrast even more acute, why the MCIC’s value proposition problem is about to get much worse, and why Anti-Consulting is a superior model for the future.

Why GenAI May Spell Doom (or at Least Irrelevance) for Legacy Management Consulting

All companies must understand and embrace the fact that accelerating AI capabilities represent a profound, multi-dimensional risk to their sustainable revenue growth, and may cause lines of revenue to meaningfully decline over the next 5 years. This is particularly true for software and software-enabled services businesses, whose offerings will be threatened with obsolescence by new, AI-centric customer experiences and value propositions. The danger is even more pronounced for companies who act as knowledge intermediaries, or whose customer concentration or sales channels are more exposed to AI-related labor displacement or service obsolescence.

What does this risk look like for software-centric businesses? It’s not pleasant. As AI capabilities become increasingly powerful and pervasive, the consequences of standing still will be extreme, with revenue growth first slowing then moving negative at an increasing pace.

In an AI-driven market ecosystem, everything will happen faster for established businesses—whether that is slowing growth or revenue decline for those that fail to evolve or accelerating growth and value multiplication for those who thrive in their adoption and embrace of AI-centric strategies.

THE CONSEQUENCES OF STANDING STILL IN AN AI-CENTRIC MARKET ENVIRONMENT

.gif?width=1920&height=1080&name=Annual%20Revenue%20Animated%20Graph%20(2).gif)

Look at that chart again, and consider what it means in the context of any company’s next capitalization transaction. There are entire portfolios of middle-market software and software-enabled services businesses that face a real threat of slowing growth and revenue erosion over the next 2-5 years, due to the rise of increasingly powerful AI capabilities. What does this mean for individual portfolio company exit values? What are the implications on the IRR of a particular fund, or the ability to raise the next one? Middle-market companies and their capital backers must urgently carve a path toward remaining competitive in an AI-centric market environment, or face previously unfathomable outcomes.

We’ve already established why speed and integrated, top-line value creation are antithetical to Legacy Consulting Models. So their response to the rise of AI over the past year has been utterly predictable. In the aftermath of the sudden Generative AI market lightning strike in early 2023, the MCIC sprang into action, accelerating investments in their AI practices, acquiring boutique AI shops, and ramping up their powerful research engines to fuel a major cycle of new programs to help clients navigate this new AI-first environment.

With unsurprising uniformity, the usual suspects went to market with GenAI programs focused on driving value through incremental, operational productivity gains and margin enhancements. Each published thought leadership and designed programs focused on how GenAI can automate human tasks and compress cycle times in areas like customer operations, sales and marketing, software engineering, and R&D.

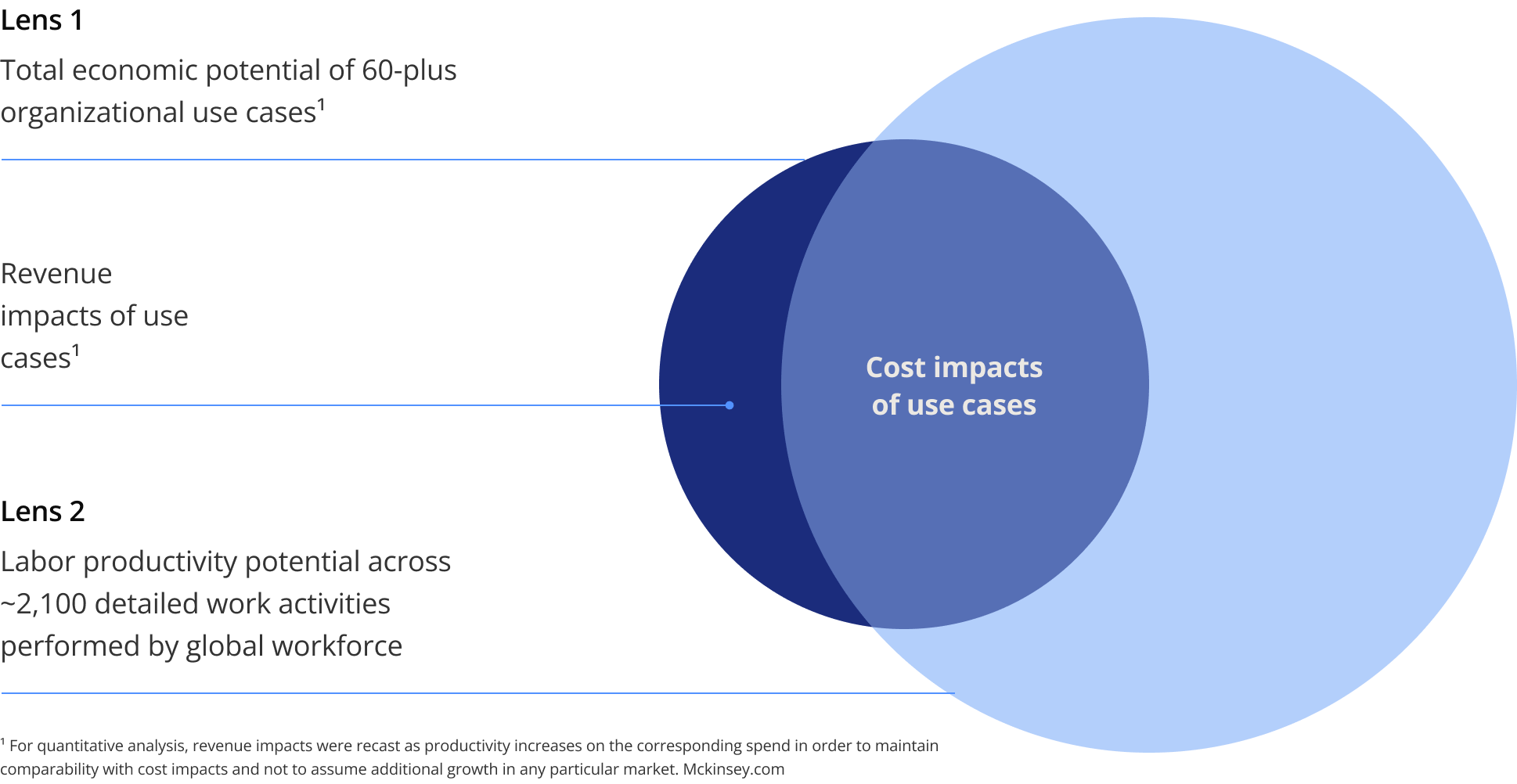

McKinsey published a fantastic report last June called “The Economic Potential of GenerativeAI: The Next Productivity Frontier.” Check it out. It’s really good. It also represents a perfect archetype of a Legacy Consulting approach to a major new shift in technology, focusing on 63 organizational use cases for productivity enhancement, which they estimate could add $2.6 Trillion to $4.4 Trillion of value to the global economy.

This graphic from that report distills this worldview well.

THE POTENTIAL IMPACT OF GENERATIVE AI CAN BE EVALUATED THROUGH TWO LENSES.

To be clear, these use cases—individually and collectively—represent a valuable application of this powerful new technology. Cost reduction, increased productivity, and improved profitability are, unquestionably, value creation initiatives worthy of pursuit and investment.

However, while important, this approach ignores the other, more critical part of the AI value creation equation: What strategies will you deploy to avoid the revenue erosion scenarios in that terrifying chart we discussed earlier? What is your path to product differentiation, sustainable revenue growth, and category leadership in an AI-centric era?

Look at the role that revenue plays in that McKinsey graphic. It’s a tiny sliver of a fingernail clipping. Once again, the leaders of legacy consulting are ignoring the question “How do we help our clients win?” And this time, they’re also ignoring the question “How do we help our clients not die?”

Slow, incremental gains based on a multitude of Legacy Consulting operational use cases may also fundamentally hamstring a company’s ability to tackle these more strategic and urgent questions, as they may result in the diversion of key resources, the oversight of valuable data assets, and the accumulation of unnecessary technical or data “debt.”

Many companies are under the false impression that AI strategy is exclusively a technical strategy, and once they are given use case trail heads, they start scrambling in their technology and engineering organizations to make platform decisions, pick an LLM, and do a multitude of experiments. They are missing the point. Just as before the Gen AI lightning strike, building winning value creation strategies in the age of AI means figuring out how you can leverage your most pronounced differentiators to win your market and drive toward superior outcomes. Technology decisions should happen after that alignment has taken place. Not before.

Ultimately, the challenge with focusing only on efficiency gains and EBITDA enhancement is similar to the problem with walking down a busy metropolitan avenue while obsessing over health data on your watch: an exclusively inward focus dramatically increases your likelihood of getting hit by a bus. In this case, that bus is GenAI.

Why Anti-Consulting is the Optimal Model for the Age of AI

Let’s use the McKinsey graphic to illustrate the point that in the age of AI, the need for a new model of value creation strategy consulting is even more urgent. Where the MCIC focuses on incremental, operational gains and OpEx-oriented value creation, Anti-Consultants focus on more existential and exponential problems to solve. Where the MCIC sees top-line revenue growth as a sliver of a fingernail clipping, Anti-Consultants see it as the more fundamental value driver (and value destruction inhibitor) in an AI-centric market environment. Put differently, carving 3% out of your OpEx cost structure is great, until your revenue growth turns sharply negative.

%20with%20Titles.gif?width=1920&height=1080&name=GenAI%20Venn%20Diagram%20(Blue%20Stagnant)%20with%20Titles.gif)

Businesses must develop and execute AI-centric value creation strategies that combine the three pillars of wisdom—Commercial, Product, and Corporate Development/Capital Transactions— if they are going to survive and thrive over the next few years. It’s not just about preventing revenue declines, AI creates new rules of the game where market advantage can be captured more rapidly than at any previous moment we’ve experienced.

Existing software and software-enabled services businesses that can exploit their current differentiation and effectively transition to AI-centric market offerings will be poised for accelerated growth and market share gains while others fall by the wayside. In an AI-centric market environment where data is the fuel of differentiation, corporate development strategies can be deployed to acquire data assets and ecosystem touchpoints that were previously uninteresting, but now represent unfair competitive advantages.

When you consider the upside opportunity associated with integrated value creation in the AI age, our terrifying chart starts to turn exciting. It’s not just about not dying. It’s about accelerating sustainable growth and paving new paths to enduring category leadership.

Look at those divergent paths. Ask yourself which curve you want to be on. And realize that the work needs to start now.

.gif?width=1920&height=1080&name=Annual%20Revenue%20Animated%20Graph%202%20(1).gif)

So how do the principles of Anti-Consulting change when factoring in the amazing power and disruptive potential of continuing AI innovations? They don’t. Not at all. They just become more critical. All the same rules apply. They just need to factor in the new variables AI brings to the equation.

.png?width=2042&height=1620&name=Group%201191%20(1).png)

In the coming weeks, we’ll do deeper dives on the principles of AI-Centric Anti-Consulting, how integrated, top line value creation strategies make major gains possible in aggressive time frames, and why you’ll never look at Legacy Management Consultants the same way again.

Conclusion

This past Summer, we at Thinktiv were finishing up an AI-centric, integrated value creation strategy project for a Fortune 500 client, during which we applied all the principles outlined here. We ultimately engaged with ~250 of their top global executives over 90 days, and moved them to a new, AI-centric view of their global market opportunity. Meanwhile, elsewhere on the headquarters campus, they had an army of resources from a leading MCIC diligently identifying dozens of use cases for productivity enhancement. At the end of the project, we had a 2-hour readout with the CEO, whom we had met a couple times along the way and who had been monitoring the program. At the end of the discussion, this CEO—who had been with this company for over 25 years—looked up at us and said: “You know, out of all the consulting projects we’ve done over the years, this one is my favorite. You’ve allowed us to see what is possible.”

Amen.